In 2020, Kia announced its mid/long-term future strategy ‘Plan S’; The company has announced that it would transform into a mobility solution provider to lead the future mobility industry through business expansion such as electric vehicles, mobility solutions, mobility services, and PBV (Purpose Built Vehicle). The fact that the company changed its name last year and the introduction of EV6 - the first dedicated electric vehicle - are also part of Plan S.

Starting with the EV6, Kia plans to introduce two or more new electric vehicles every year after 2023, following the Kia flagship model EV9 scheduled to be released in 2023. Subsequently, it plans to lead the popularization of electric vehicles by establishing a fully electric vehicle lineup of 14 car types by 2027 while raising the annual electric vehicle sales target to 1.2 million units in 2030 to become a top-tier electric vehicle brand.

In addition, it is pursuing a strategy to preemptively respond to the rapidly growing mobility service market by introducing a variety of PBVs based on electrification and autonomous driving. Kia’s PBV business aims to achieve PBV Global No. 1 by providing customized solutions in various mobility service fields such as e-commerce, logistics, shuttle, and robot delivery, and by flexibly producing vehicles for multiple purposes of customers.

So, what exactly is PBV, which Kia pursues as its future core business? PBV means a vehicle with a simple structure, focusing on the purpose of use, beyond the concept of a current vehicle designed for the driver. Utilization should be increased through a modularization-based platform that can flexibly change design and interior space, and safe and efficient movement should be provided using autonomous driving technology and an electrified powertrain. Therefore, it is responsible for self-movement and passenger transportation between two areas within the city, or movement between one location and one mobility.

The reason Kia is actively entering the PBV business is that the ecosystem of the mobility industry is rapidly changing. The rapid spread of the consciousness of sharing a car instead of owning it has expanded mobility services such as car-sharing and ride-hailing. In addition, the impact of the COVID-19 pandemic, which started two years ago, has brought radical changes not only in our daily life but also in the mobility industry. The value of personal space, such as a house or car, where you can keep a safe distance from others, has increased. The last-mile delivery industry has proliferated as non-face-to-face e-commerce and logistics services for small businesses. Accordingly, the use of mobility is also rapidly changing. In addition, strong environmental regulations in developed countries such as the US and Europe are also accelerating the transition to eco-friendly mobility. This is why the emergence of eco-friendly PBVs specialized for various mobility services has accelerated.

The prospect of PBV can be predicted through the LCV (Light Commercial Vehicle) market in Europe and North America. This is because LCV, used in passenger transportation and logistics business, is expected to evolve into PBV. LCV is a type of vehicle that was born mainly in Europe. It refers to small and medium-sized commercial vehicles with a total weight of fewer than 3.5 tons and includes all types of vehicles such as vans, minibusses, and pickup trucks. If it is judged to be of the same style and grade, it is classified as an LCV even if it exceeds 3.5t.

LCVs generally have low body and sliding doors, making it easy for people to load, ride, and value economy (efficiency). For this reason, unlike large logistics trucks that mainly operate long distances, it is being used as mobility optimized for the urban logistics industry centered on short-distance delivery, leisure, shuttle, and mobility sharing services. In other words, this is where future PBVs will thrive. Furthermore, PBV is expected to be larger than LCV as it is expected to be used in more diverse fields such as last-mile delivery.

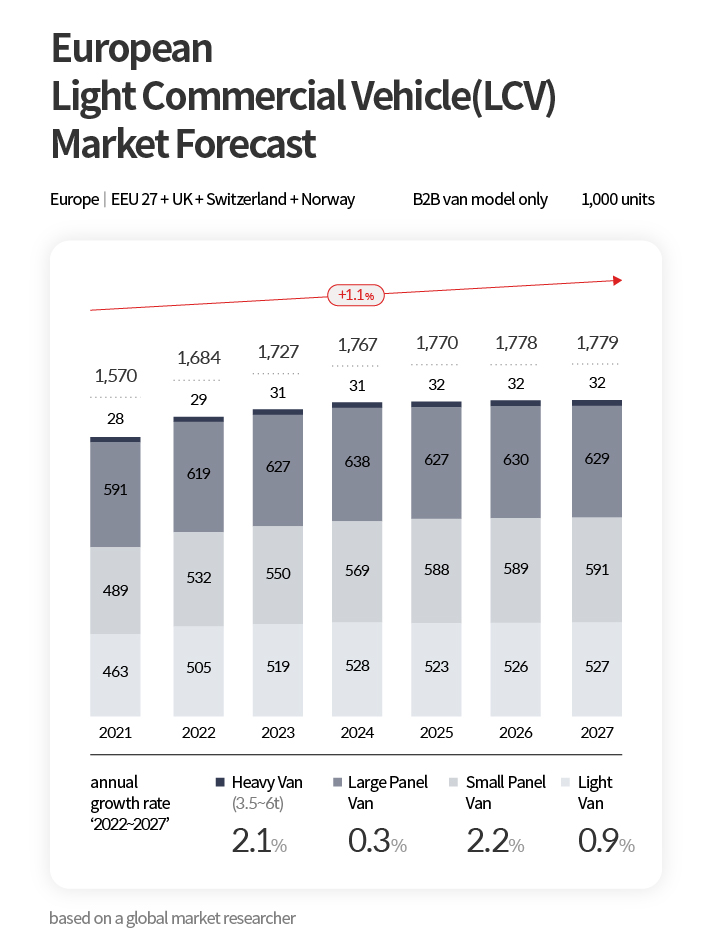

In Europe, LCVs are classified into small vans, heavy vans (3.5-6t class), medium vans, and large vans according to the car’s shape, size, and utilization, with sliding doors and roofs. The LCV market is centered on vans with cargo boxes. This is easy to understand when thinking of mobility that can be used for various purposes, such as Hyundai’s Staria, Solati, and Kia Carnival in Korea.

According to global market research companies, the European LCV market (limited to B2B vans) is expected to grow steadily until 2027, five years from now. This seems to be attributable to the rapid change in the urban logistics market, the expansion of logistics delivery due to the growth of e-commerce, and the rapid expansion of mobile sharing services.

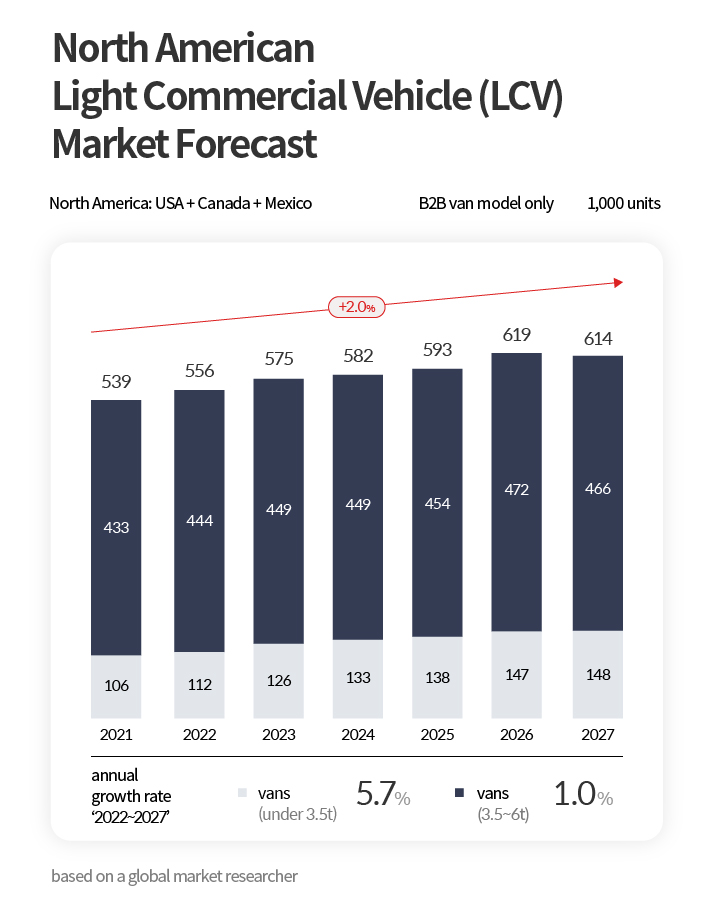

The steady growth of the LCV market (B2B market only) is expected to continue in North America (USA, Canada, Mexico). In the case of the North American market, the classification of LCVs is slightly different because Canada classifies LCVs as in Europe. Still, the United States includes LCVs in the area of light-duty trucks. The United States classifies vehicles such as pickup trucks or truck-based vans and SUVs with a gross weight of fewer than 8,500 pounds (3,860 kg) as light trucks, similar to the European LCV concept.

However, the difference is that in Europe, where the LCV market is the largest, the market is centered on vans, whereas in the United States, which has the largest market in North America, pickup trucks are sold the most rather than vans. Based on the fact that PBVs will replace LCVs, they predicted the demand for the LCV market by limiting it to commercial vans in the B2B (business-to-business) market. As a result, it was found that North America was smaller than Europe in terms of the size of the market itself. Also, unlike in Europe, where various brands sell LCVs of various sizes, the market outlook points out that fewer types of van models are sold in North America, focusing on large vans.

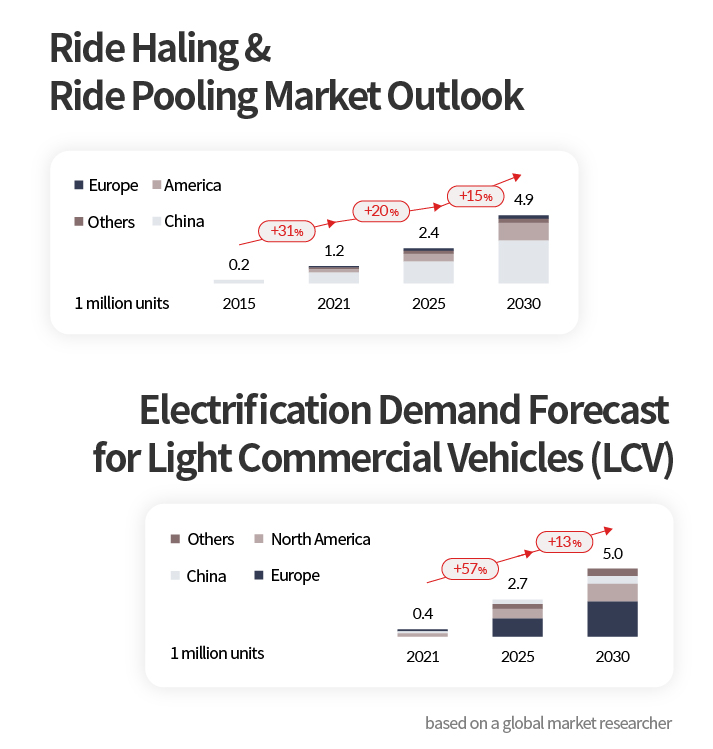

The rapid expansion of mobility sharing services such as ride-hailing and ride pooling is also driving the growth of LCVs. According to the results of several market forecasting companies, the global expansion of mobility sharing services such as ride-hailing and ride-pooling is expected to explode from 1.2 million units in 2021 to 4.9 million units in 2030.

Ride-hailing is a service for small passengers that connects consumers who want to move and a transport service provider. Kakao Taxi (ride-hailing) and Hyundai Motor Group’s Shucle (ride pooling) are representative ride-sharing services in Korea.

The fact that electrification of the mobility industry has become an inevitable trend as large cities around the world enforce strong environmental regulations on the automobile industry is also a factor that can positively predict the growth of eco-friendly PBVs. In line with the trend of mobility electrification, the electrification of LCVs is also expected to follow a set sequence. Global demand is expected to reach approximately 2.7 million units in just four years, from 400,000 units in 2021 and 5 million units in 2030. Considering that PBV will ultimately be positioned as mobility that will replace LCV, it becomes clear how big the PBV market will be.

London in England and Paris in France have banned diesel vehicles from entering the city center. London has announced that it will ban the sale of internal combustion engine vehicles from 2040. Spain has also announced that it will ban the sale of diesel vehicles by 2025. The state of California, which is a representative green regulatory region in the United States, has announced that it will phase out the sale of new vehicles with internal combustion engines by 2035 and that it will include ride-hailing mobility as a target of driving regulations for carbon-emission vehicles (20% in 2023 and 50% in 2026). In China, too, the government has been taking the initiative in proposing regulations for mandatory sales of eco-friendly vehicles to automakers since 2017 and recently announced that it would suspend the production of general internal combustion engine vehicles by 2035.

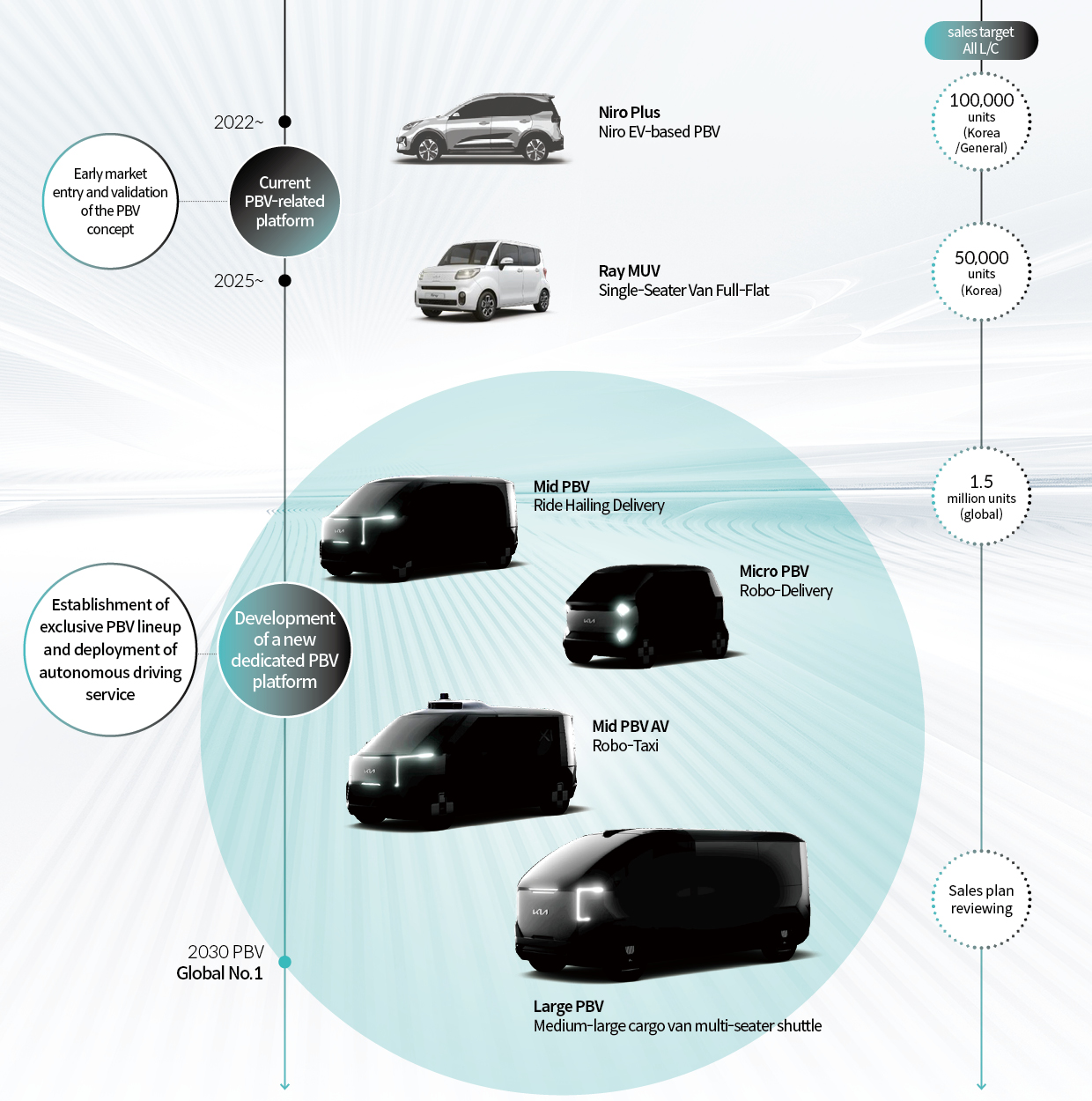

Kia’s journey to lead the PBV market has just begun. Kia plans to pursue various methods to provide products, services, and solutions optimized for customers’ businesses. They will expand the lineup of derivative PBVs and dedicated PBVs, establish customer communication channels, and operate a customer-participating PBV development process.

In addition, the company plans to establish a flexible production system by actively utilizing the new PBV-exclusive factory and external ecosystem, and build an integrated data platform to realize more convenient and seamless services. In the short term, they plan to pioneer the PBV market through derivative PBVs. In addition, the mid-to-long-term goal is to become a Global No. 1 PBV maker in 2030 by expanding dedicated PBVs and autonomous driving technology.

First of all, this year, according to the purpose and taste of the user, it unveiled a single-seater van Ray that can be used for various purposes such as logistics transportation, mobile stores, and leisure. The Ray single-seater van, released on February 8, is the first mass-produced model that can give a glimpse of Kia’s PBV direction. Based on the Niro EV, which is scheduled to be released this year, the Niro Plus is a derivative PBV model that features a comfortable interior space by increasing the overall height and significantly improving rideability. The first dedicated PBV model, scheduled to be launched in 2025, will be developed as a mid-size PBV considering various business growth rates such as hailing and delivery. Then it is planned to expand to micro-and large-sized PBVs.

In addition, Kia’s PBV business includes the PBV model and solutions that support operators’ businesses. Specialized packages such as mobility packages and delivery packages are provided to enable selective combinations according to customer needs in the entire process from vehicle purchase to disposal. In addition, they plan to strengthen our PBV business capabilities through collaboration with startups and local governments and open innovation. At the beginning of last year, the automaker signed an agreement with Singapore cold chain (refrigerated logistics) startup ‘S-lab Asia’ to promote a PBV pilot project.

Last year, the company signed an agreement with Kakao Mobility to distribute eco-friendly electric taxis in Korea as soon as possible. Kia provides electric vehicles and related technologies, charging infrastructure, battery and vehicle warranty, and maintenance support. Kakao Mobility is a strategic collaboration that utilizes a mobility service platform to complete a customized solution for electric taxis and further contributes to establishing an electric vehicle industry ecosystem. In February, the company collaborated with the Korea Transportation Safety Authority to develop an automatic connection system for taxi operation information for the Niro Plus, which is scheduled to be released this year. Based on such collaboration and open innovation, from 2025, Kia’s PBV lineup, which is optimized for a variety of uses, from ultra-small to large, is soon to be unveiled.