We are seeing more and more PLCC cards these days. PLCC, Private Label Credit Card, is a card jointly operated by a company that wishes to have its own credit card and a card company, which focuses on providing benefits, services, etc. for the said company. It was mainly developed in the U.S., but since last year, it has become quite common in Korea as well, as there are more card companies that actively issue PLCCs. Hyundai Card is leading the Korean PLCC market. Last year, it developed Costco’s PLCC and Starbucks’ PLCC, as well as Korea’s first airline credit card with Korean Air. This year, Hyundai Card focuses on mobility.

Why was a mobility specialized card developed? It’s related to changes in time. With the 4th industrial revolution, the concept of mobility expanded. It has become a life partner to many, with innovative technology implemented, going beyond being a transportation means. Hyundai Motors leads the evolving mobility life. With innovative mobilities such as UAM (Urban Air Mobility), PBV (Purpose Built Vehicle), autonomous vehicle, etc., it already had predicted the advent of a new lifestyle that surpasses the time and space limitations of mobility. Hyundai Card redefines the ecosystem for providing mobility life benefits in sync with Hyundai Motors’ future mobility vision and focuses on Hyundai Motors client-oriented customized benefits.

It’s not the first time Hyundai Motors collaborated with Hyundai Card. In 2017, there was the Hyundai Blue Members credit card. This card included the Hyundai Motors client service, Blue Members points benefits and Hyundai Card’s M point benefits. As it provided many car-life related benefits, around 900,000 membered had been issued a Blue Members credit card in the last 4 years, which was widely popular with around 840,000 KRW worth of monthly use on average per person. This year’s new mobility specialized card is like the upgraded version of Blue Members credit card. What benefits does it include?

Hyundai Mobility Card is categorized into Hyundai Mobility Card and Hyundai Mobility Platinum Card. Both cards are distinct in that they focus on providing accumulated rewards in Blue Members points. Compared to the previous the Blue Members credit card, point accumulation benefits are upgraded when using car life related services including gas, repair, car wash and mobility related services such as car sharing, etc. Considering how mobility life is not concentrated on a specific area but throughout our everyday life, clients who use more than 500,000 KRW a month are able to accumulate Blue Members points for 1% of every money spent at all member stores without limits.

Hyundai Mobility Card is specialized in mobility life, mainly regarding the benefits needed for clients who are purchasing a new car. You can accumulate up to 3% if you use the card for maintenance and repair services such as gas and car wash and up to 2% if you use the card for mobility services such as public transportation, SoCar, TADA, etc. You can also accumulate points when purchasing a new car; purchasing a Hyundai Motors automobile provides the special benefit of accumulating 1.5%. The Hyundai Mobility Platinum Card boasts a higher point benefit percentage than the Hyundai Mobility Card. If you use more than 2 million KRW a month, you are able to accumulate up to 4.5% in Blue Members points. Blue Members points can be used in purchasing a Hyundai Motors automobile, for maintenance and repair, as well as at the Blue Members point mall. It can also be transferred to smile cash at G market, Auction, etc. and be utilized just like cash.

There’s also a card for eco-friendly automobiles, which is being noticed especially by the mobility industry. Hyundai EV Card provides reward benefits when recharging electric and hydrogen cars. Depending on how much you use a month, you can accumulate 50~100% in Blue Members points when you recharge your electric or hydrogen car with it. If you use more than 800,000 KRW a month, you can accumulate up to 20,000 Blue Members points. Check out the below link if you wish to find out about the Blue Members points accumulation centers.

Just like the Hyundai Mobility Card, the Hyundai EV Card enables you to accumulate Blue Members points when used for automobile maintenance and repair services such as parking, car washing, and Hi-Pass and other services like public transportation, TADA, etc. If you use more than 500,000 KRW a month, you can accumulate up to 3% in Blue Members points. The sensuous card design also plays a role in attracting clients. If you are a Hyundai Motors’ electric or hydrogen car owner, enjoy a sensible mobility life with the Hyundai EV Card.

A card just for Genesis was created in consideration of Genesis owners’ tendencies. Genesis Card includes various benefits, which allows you to feel the change in mobility with Genesis while enjoying the premium life. Blue Members points are provided as basic rewards; the card was designed with a focus on the mobility life experienced with a premium automobile. Depending on an owner’s car type, one can choose between Mobility Service and EV Service.

For example, let’s compare an owner of Genesis G80, A, and an owner of Genesis Electrified G80, B. When both of them drive about 1,500km per month, A can be assumed to spend about 300,000 KRW for gas a month while B spends about 100,000 KRW a month for recharging. If both of them spend more than 800,000 KRW a month with the card, each card service allows A to accumulate 13,500 points and B to accumulate 20,000 points each month for just gas and recharging.

Another feature of Genesis card is that it enables you to accumulate 5% of what you spend at premium businesses in Blue Members points. The more often you use premium businesses such as travel, flights, hotels, department stores, golf, etc., the more Blue Members points you accumulate. It also provides Hyundai Card platinum services such as free use of airport lounge, discounts at coffee shops, free weekend parking, etc. For example, a G80 owner who spends 2 million KRW a month with the card can accumulate maximum points for each subject business up to 300,000 KRW monthly limit. You can accumulate up to 54,000 points just with the basic rewards which include automobile maintenance, mobility, premium sector special points, etc. Such accumulated Blue Members points can be used like cash when purchasing a Hyundai Motors car, for repairing services, as well as at Hyundai Department Stores, Hyundai Outlets, E-Marts, Auction, G Market, etc.

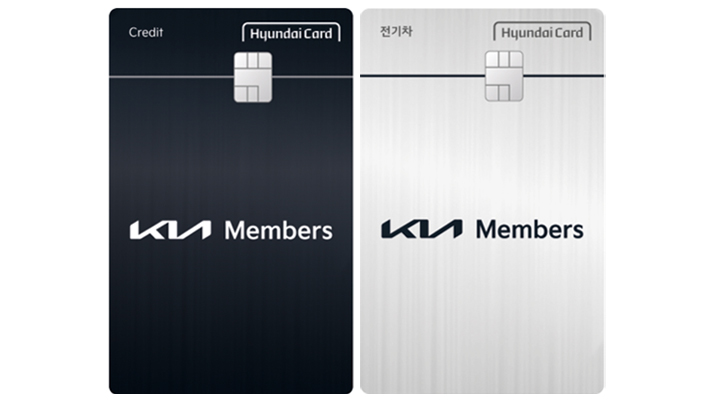

Kia owners’ exclusive cards feature different cards for different car types, including electric and compact cars. Kia Members credit card Edition2 is the upgraded version of the previous Red Members credit card. Accumulation of M points and Kia Members points have been upgraded. Depending on how much you spend a month, you can accumulate up to 1% of what you spend at domestic/international member stores in M points. If you purchase a new Kia automobile, 20,000 Kia Members points will be accumulated. If you use more than 6 million KRW with the card a year, you will be provided with 10,000 Kia Members points the following year. You are also able to receive regular annual check-ups and automobile care service for 8 years.

If you are a Kia electric car’s owner, pay attention to Kia Members electric cars credit card. You can get discounts for recharging electric cars. If you spend more than 500,000 KRW, you will get a 30% discount, and a 70% discount if you spend more than 1 million KRW. It also allows accumulating M points and Kia Members points, which can be partly used in many member stores when you are refueling, eating out, watching movies, traveling, etc.

Kia Members compact car card, for Kia compact car owners, is categorized into a regular compact car card and a card for fuel tax refund benefits. Anyone with a Kia compact car can be issued one. It includes benefits for a safe car life. Depending on how much you have used the previous month, you can be rewarded with up to 360,000 KRW worth of gas discount benefits and receive 30,000 KRW discount for Hyundai Marine & Fire Insurance’s car insurance each year. The Fuel tax refund card is a card for compact car fuel tax refund subjects. Along with the regular compact car card benefits, it also provides up to 200,000 KRW fuel tax refund benefits each year.

▶ Find out more about the Kia exclusive card

The advent of mobility life specialized cards means that mobility has become very important for our lifestyle. Cars are now used not just to commute but to go camping and driving, for leisure purposes as well. Hyundai Card’s newly launched mobility specialized card not only provides Blue Members and Kia Members points which can be used like cash but also the upgraded M points benefits to make it much more useable. Experience a fun mobility life with Hyundai Card’s mobility specialized card.

A Paradigm Shifter, Shifting Towards a Hydrogen Society

2022.01.17 12min read